Leverage Points and Where to Find Them

Four case studies of finding leverage points that dramatically improve businesses with minimum effort

In this issue of the newsletter I wrote about the most useful skill to learn as a data professional, which I believe to be your ability to find points of maximum leverage in a business that drastically improve performance with relatively little effort.

So the logical next question is, how? The answer is simple but not easy. Use patterns lifted from case studies. In this newsletter we’ll get into two of my favorite patterns and two case studies for each.

Pattern 1: Lifting demand constraints

Pattern 2: Plugging revenue leaks

Lifting Demand Constraints

As data professionals you’re probably familiar with things like funnel analysis. It’s an awesome way to find inefficiencies in sales and marketing processes. But you almost never think about demand.

You can often get 2x to 10x improvements in sales or marketing ROI by fixing demand vs doing funnel analysis. Yes funnel analysis can reveal leakage, as we’ll explore later, but before going there, look at demand constraints first Doing that can mean anything from improving the offer, the product, positioning, pricing, etc.

Here are two case studies where improving demand led to massive improvements in profitability. I’ve deliberately chosen non-SaaS examples to show that these patterns apply everywhere.

Case Study 1: Improving restaurant profitability

Restaurants are notorious for being low-margin, high-failure businesses. They’re capital intensive (the kitchen alone can cost $15,000 to $150,000) and have high fixed costs. Rents and operating costs are a constant drain.

And yet profitable restaurants do exist.

In an interview on the Tim Ferriss podcast Nick Kokonas, who is known for his partnership with chef Grant Achatz, owning several high-end restaurants and for founding the reservation business Tock, explains how he completely turned the restaurant model in its head.

Demand for most restaurants is their biggest constraint.

In the US you can walk into a restaurant at almost any time and get served the full menu. This doesn’t come cheap. The kitchen needs to be stocked and operational, which means you have to have someone on staff capable of cooking every dish. The waiters need be ready to serve and the bar is often open and tended.

Meanwhile demand is unpredictable and spiky. You’re either at the whim of customers walking in or them booking a table in advance that can be canceled at any time. Restaurants are not alone in this. Airlines and hotels for example face the unpredictable demand issue.

Unlike restaurants however, hotels and airlines deploy several techniques to handle such demand: they often have dynamic pricing, their reservation systems require upfront payment, a deposit that comes with a cancelation fee.

This is where Nick Kokonas’ ingenuity comes in. While Grant Achatz (who was prominently featured on Netflix’s Chef’s Table Vol. 2 Ep. 1) created amazing dishes and a once-in-a-lifetime experience, Nick decided to treat each table and time slot as bookable and opened up paid reservations far in advance.

If hotels and airlines do it, why not restaurants? You can even go further and implement “surge pricing” which for restaurants can be as simple as increasing prices on peak demand days.

With demand exploding after the Netflix documentary, people booked in droves. Having cash in the bank and demand locked in, Nick challenged another convention in the restaurant business. He paid for food in advance.

So instead of getting net 90, or net 60, which is what every restaurant tries to get, we actually negotiate a discount by prepaying that and then sort of truing up afterwards. So for our big-ticket items, we try to stay a couple months ahead on payments, in order to get more favorable terms and better product.

Case Study 2: Improving profitability at manufacturing plant

This next case study comes from a personal conversation I had with the CEO of a manufacturing plant. This is a small plant that produces a plastics product that retrofits existing infrastructure without needing costly replacements.

When he joined as interim CEO the plant was facing several problems. They had some demand but it was spiky and inconsistent. They were selling both directly to installers (B2C) and to distributors (B2B) and losing money monthly. Weekly sales tracking showed that growth was happening but only in big spikes.

Since we’re both Theory of Constraint fans, we had discussed potential constraints inside the plant. He’d mentioned that the manufacturing process itself was simple and well optimized so the biggest constraint was demand. His key decision was figuring out whether to focus on B2B or B2C.

Interestingly the spikes occurred when distributors bought large quantities. Using simple XMR charts, he decided that the best way to move forward was to focus on B2B and sell only to distributors. But there was a twist.

Rather than waiting for them to place orders, he signed distributors up with minimum monthly deliveries and recurring payments. After signing up the first distributor in the beginning of the year, revenue started to recover. 3 months later, another 4 distributors had onboarded and revenue doubled.

This single lever shifted the constraint from the market back to operations and the supply chain. With predictable revenue came predictable cash flow and he could now shift his focus back to the factory to expand production capacity and explore new products. He mentioned today they have tripled the product line!

Plugging Revenue Leaks

Next we look at two cases where plugging revenue leaks led to massive improvements. What’s cool about this pattern is that you can get wins quckly by just looking at key business processes and doing funnel analysis. You just need industry benchmarks.

Case Study 3: Plugging a massive email deliverability issue

The third case study comes courtesy of True Classic, an e-commerce company who sells t-shirts. They had become somewhat famous from viral TikTok and Instagram videos, so demand wasn’t really an issue. The issue was a leaky bucket.

In an interview for the Limited Supply podcast, Ryan Bartlett (co-founder and chairman) shared a story of finding a huge revenue leak courtesy of a new hire.

When Ryan hired Ben Diamond (current CEO), they were 13 months into the business. Within a week of starting, Ben discovered that the email opens rates were in the low 20%. Industry standards are about 40%+. It turned out they had massive deliverability issues with all their emails being sent straight to spam!

Talk about an insight, right?

Customer acquisition cost (CAC) is the biggest driver of profits in a D2C business (but really in any business) Email sending costs are nearly $0. By using clever segmentation and good copy, you can generate revenue without additional marketing spend. Re-ocurring purchases will help build a lasting business.

You can use all sorts of fancy growth tactics, viral videos, podcast appearances, direct advertising, etc. but if you have a leaky bucket, if you’re losing customers daily, you’re not going to have a business for very long.

Case Study 4: Plugging a huge CAC (customer acquisition cost) issue

Our final case comes courtesy of Alex Hormozi. In this video he’s helping a Ashley Capps (owner of AC Styles) get to $5 million in revenue. AC Styles is a professional wardrobe and personal styling service helping high-end clients improve their confidence by improving their style, wardrobe and fashion sense.

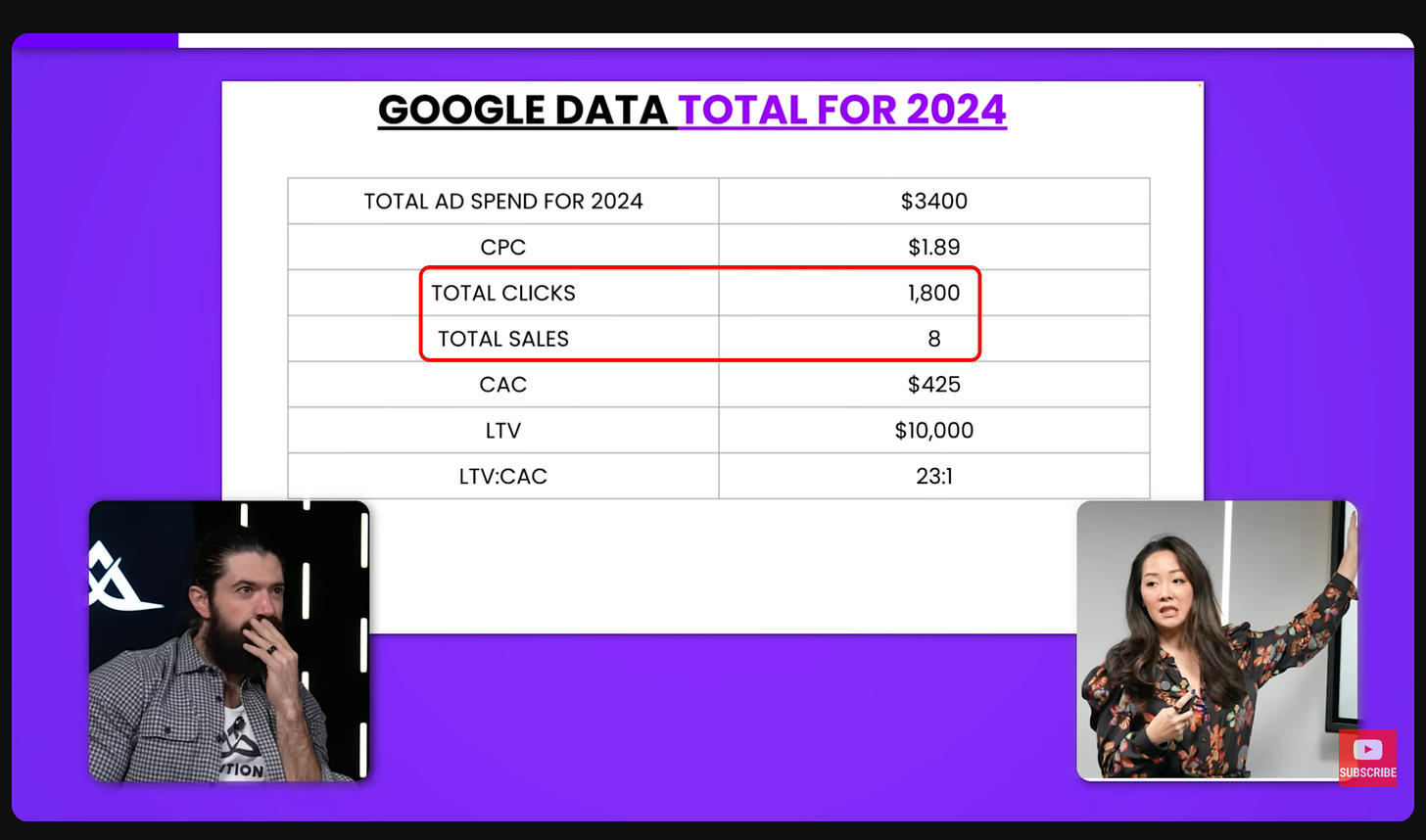

The business is otherwise very healthy (42% net margin) but this slide immediately caught my attention. 8 sales out of 1800 clicks is 0.045% conversion rate. Talk about a leaky bucket! Yes this is basic funnel analysis, a staple of marketing analytics these days, but this is still shocking to see.

The reason for such a low conversion rate was a poorly designed landing page. The page was just a google form where you put in your contact information and the company calls you to schedule a consult. That’s it! No lead magnet, no lead qualification and massive friction.

To fix the issue, Alex recommended designing a good lead magnet, reducing the friction and adding intermediate steps for signups. Now I’m not against friction in the signup flow. It can help reduce low quality leads dramatically, improve your CAC and profitability. But it requires a delicate balance. No friction is just as bad as having too much.

That’s it for this week.

Hope you enjoyed the case studies and they gave you some ideas about implementing something similar in your company. If you have questions or want to let me know you enjoyed this issue, leave a like, a comment or reply to this email.

I read all emails and love getting feedback. It often feels like shouting into the void.

Until next time.

Love this format and story telling -

Excellent content, thanks!