Designing Metrics Trees

The heart and soul of a company's growth model

In a recent post on LinkedIn my friend Abhi Sivasailam introduced everyone to metric trees. I also briefly covered the idea in a post. Last week we also covered Dashboard Trees and one of the key questions there is: What goes inside a dashboard?

The answer? A metric tree!

What’s a metric tree?

A metric tree is a logical representation of a business’ growth model in a graph form. It’s a simplified representation of how inputs flow into outputs.

Metric trees are composed of:

Output metrics

Input metrics

Relationships amongst them

Let’s see what it looks like:

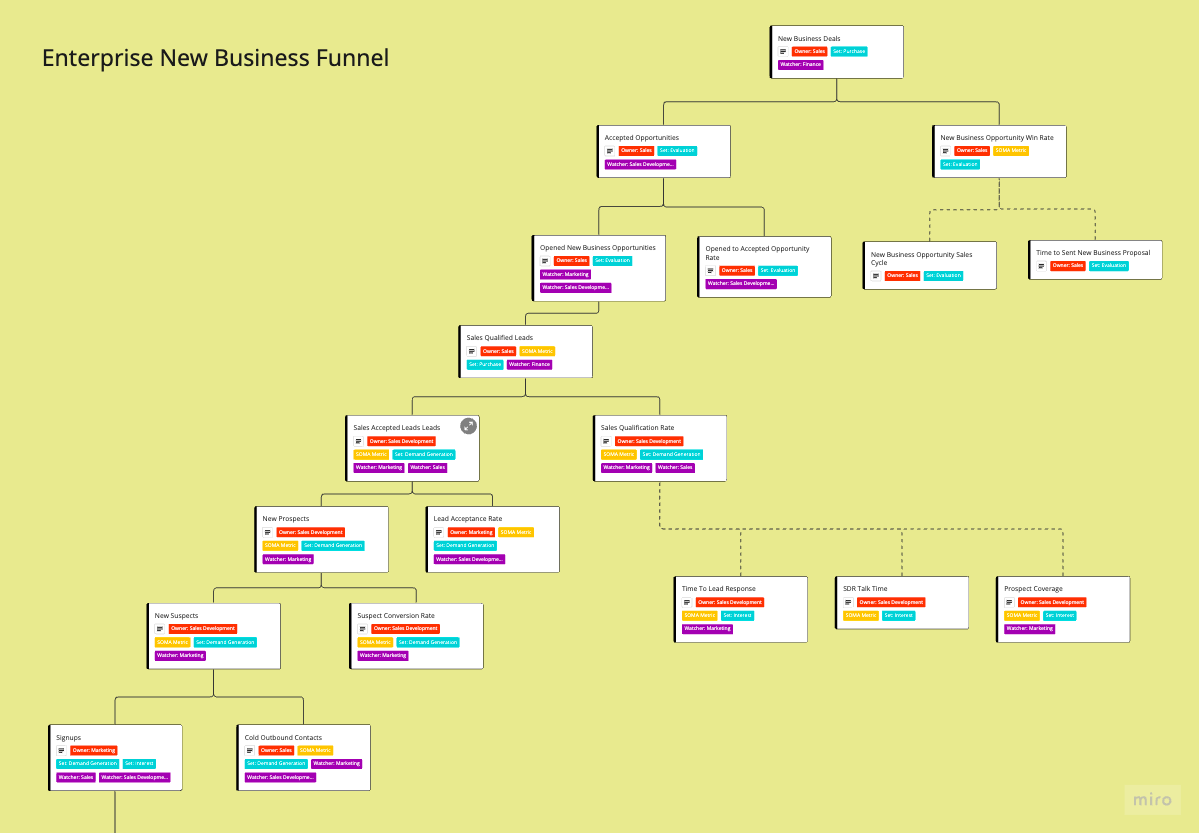

Every tree has a “north star” output metric and multiple input metrics. In the diagram above we have New Business Deals as the key output metric. This metric is defined mathematically as Accepted Opportunities * New Business Opportunity Win Rate.

So Accepted Opportunities and New Business Opportunity Win Rate act as input metrics for New Business Deals but they also act as output metrics of other input metrics. Therefore we can continue to decompose them into their components until we reach Controllable Input Metrics. We’ll talk about that briefly.

The relationship between the metrics isn’t always mathematical. Sometimes it’s causal or even correlational. This is perfectly fine. For example the New Business Opportunity Win Rate metric is influenced by (or correlated to) New Business Opportunity Sales Cycle and Time to Send New Business Proposal.

Both of those two input metrics are potentially controllable (the second one more than the first) which now allows us to build it into a model that we can use to run what-if scenario simulations and experiments to discover both “controllability” and impact.

The same thing happens further down when we look into SQLs (Sales Qualified Leads) which is a formula of SALs (Sales Accepted Leads) and Sales Qualification Rate. This rate is influenced by a handful of other controllable input metrics (Time to Lead Response, Prospect Coverage, SDR Talk Time)

You can scale the granularity of the tree as needed. The model above will be very useful to a VP of sales as their north star output metric is the total number of New Business Deals (NBD) but for a COO or CFO it has too much detail.

Their tree might simply contain the NBD metric as input and if it starts slipping, they can ask the VP of sales to investigate or they can “drill into” the subtree themselves.

Why build a metric tree?

The biggest benefit of building such a tree is that you finally get to see all the metrics and their relationships in context. Show this to any business operator and they instantly understand their domain or the entire business.

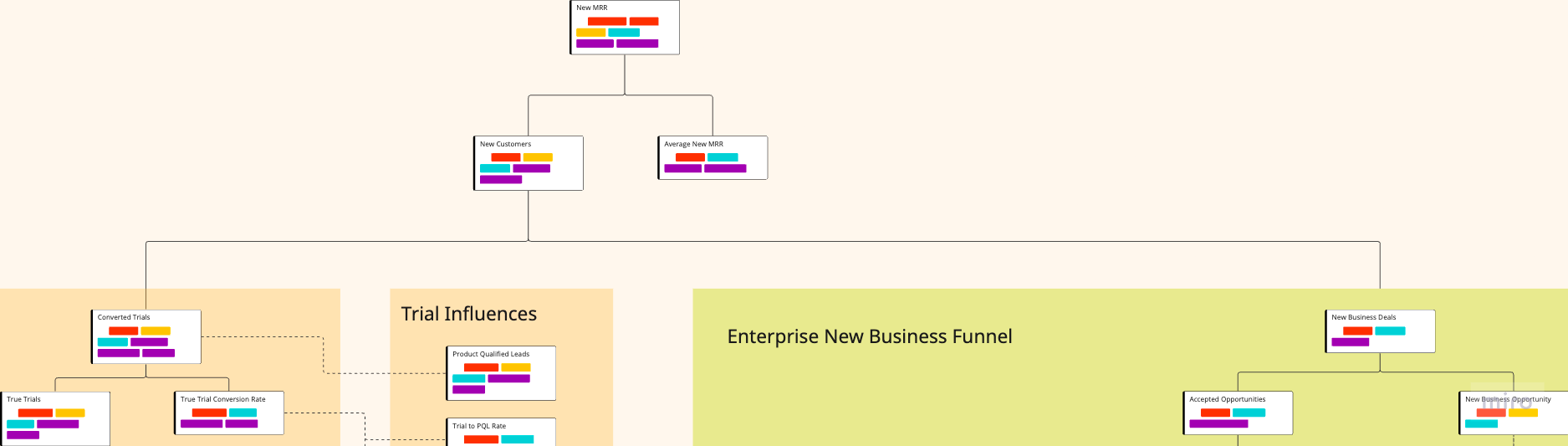

But the most important benefit is the Growth Model that you can build. As a data team, this should be one of your key deliverables. The Growth Model will map all metrics and relationships onto a tree and enable both experimentation and simulation.

Starting out you can build the model in a spreadsheet but eventually having a graphical representation will help provide much needed context for the entire business. And so this is why I stress that data professionals must learn the business.

Alright let’s get into how to build it.

Building a metric tree

Before you get started, you’ll need a list of all the metrics your business measures. If you work for a SaaS company you can use SOMA metrics which you can get here. But if you don’t, you can take as many of them as apply (for example marketing and sales ones)

You WILL need standardized metrics BEFORE you build the metrics tree. You simply cannot have a conversation with other teams in the business if you say “New Business Deals” and they understand something completely different from what you meant.

All these metrics have time dimensions (month, quarter, year) and other dimensions (like segment, geo, etc.) Dimensional shifts are one of the best ways to monitor metrics performance and investigate relationships among them.

Step 1. Define key “North Star” metric

For most businesses, the north star metrics are concepts like:

Customer Value (e.g Retention)

Financial (e.g. Revenue)

Strategic (e.g. Market Share)

Of course the full metrics tree for a business is very complex and nearly impossible to build right away so you can build the subtrees first then connect them through causal, mathematical or correlational relationships.

Step 2. Recursively break down inputs

Now we simply work our way backwards from the top until we reach all the metrics we have collected. As Abhi likes to say, you need more metrics than you think if you want to have high resolution visibility into the business. But you don’t have to build this all at once.

For example here we started with New MRR of which New Business Deals is a component which decomposes further and further as saw above. Ask yourself what are the components of that? as you keep iterating.

Step 3. Map out relationships

Next we want to map out all the possible relationships amongst the metrics. Obviously some are deterministic (formulas) and some are probabilistic (correlations) and many are not know ahead of time so you’ll need to analyze data to figure them out.

This part will take time but that doesn’t mean you can’t deliver value right away.

That’s it for this issue. Did you like metric trees? If so let me know in the comments or via a reply.

Also if you want my help building this for your business, feel free to book time with me or just hit reply to this email.

By the way you can get all these trees for a SaaS businsess on this Miro board.

Until next time.

That is such an interesting way to spread accountability across the business and have every team working on the same goal. It would be interesting to read more about its implementation.

Great article! Have you found ways to auto-populate these metric trees with actual data?