The Art of Business Analysis - Part 2

How to 10x the Performance of a Business

In Part 1 of the Art of Business Analysis series we looked at the Value Chain as a key framework for analyzing the business as a whole. In that post we looked at the case study of Chiro-1st which comprises a number of chiropractor studios in and around Washington state.

We looked at the key metrics / KPIs and built a metrics tree using the value chain. There’s a link to that post later one, but it’s not strictly required to understand this one. I’ll provide just enough context here for you to be able to follow along.

In this post we seek to answer the question: “How do we improve this business?”

Improving Systems Through Constraints

To answer that question we’ll look at another powerful framework for analyzing businesses called Theory of Constraints (TOC). I will not get too deep in the weeds of TOC because the knowledge base is vast, I’ll just focus on what you can use today.

TOC takes a wholistic systems approach to improvement. The core tenet is that every system has a goal. A constraint is a limiting factor that prevents the system from reaching that goal. It’s whatever resource you don’t have enough of to get the goal.

TOC also believes that this constraint is the only thing that matters and the only thing you should focus on to improve that system. This is quite a departure from the traditional approach which seeks to improve a business by optimizing every part independently.

The constraint acts as a point of leverage, in the sense that improving just the constraint by 10x gets you 10x improvements in the entire business. Improving anything other than the constraint will get you, at best, incremental improvements.

The five types of constraints

According to Dr Alan Barnard (who worked directly with and was mentored by TOC founder Dr Goldratt) there are only 5 types of constraints:

Demand constraint (also known as a market constraint) where you don’t have enough demand (enough market) for your products or services. Unless you have customer orders piling up or a queue of customers outside your establishment, you have a demand constraint. This is the most common type of constraint.

Capacity constraint where have enough demand but not enough capacity to handle the demand. This is usually an internal constraint based on your current operations, policies and business processes.

Supply constraint where have enough demand and capacity but not enough supply from a third party (hence an external operations constraint). This happens when you’re in the middle of a long supply chain between manufacturing and customers and are reliant on suppliers for raw materials.

Cash constraint where you’ve got plenty of demand, not enough capacity but in order to increase capacity you need money to invest. In this case the constraint isn’t capacity but cash.

Management attention where your business is doing well but you’re so busy handling daily operations and making every decision yourself that the business cannot grow regardless of demand, capacity or even cash.

As I said earlier, most businesses have a demand or market constraint, so it’s always a good idea to focus there first. That’s why it’s at the top of the list. If on the other hand you have a backlog of orders you haven’t fulfilled yet, or a long queue out the door, you have more than enough demand and you should focus on capacity/operations.

If however you don’t know what to focus on first, the best thing to do is to set an outrageous goal!

But why?

The traditional approach of goal setting in many organizations is to make sure they’re reasonable. For example “How do we grow 10% year over year?” But this type of goal will NOT expose your constraints and thus limit your upside.

When you set an impossible goal (for example how do we 10x this business?) the constraints become very clear. Let’s illustrate using Chiro-1st.

The Goal

In the video, Raymond (the owner of Chiro-1st) wants to achieve $5 million in EBITDA in 3 years and exit. This is definitely in the realm of outrageous goals, but we can go even further and ask “How do we 10x this business?”

TOC has a very simple financial equation to help you think about improvements.

There are only a few KPIs:

Throughput (Sales - Variable Costs)

Inventory or Investment (e.g. clinic location, equipment, etc)

Operating Expense (e.g. staff salaries, rent, etc.)

Net Profit = Throughput - Operating Expense

ROI = (Throughput - Operating Expense) / Investment

Let’s take a look at the numbers. Chiro-1st is making $5.2 million in top-line revenue and has a 23% net margin. If they wanted to 10x revenue, they need to 10x sales. Could they do it with the five centers they currently have? Each center has limited capacity in terms of a doctor, support staff, equipment and space.

We don’t know exactly but assume each center has one doctor working there. If we assume the duration of an appointment is 45-60 minutes, then a doctor can only see about 6-8 patients per day. We also don’t know whether the centers are operating at optimal capacity.

Decreasing the duration of an appointment can help a little bit, but that will also negatively impact patient health outcomes, which negatively impacts future sales. So the only way to 10x revenue is to open up other centers.

We know that will require upfront investment and potentially decrease the net margin, so we should try and squeeze as much performance as possible out of our current set up.

Ok this is a useful mental simulation, but let’s focus on Raymond’s original goal. Can we get to $5 million in EBITDA using our existing setup? What should we do first?

The business is already doing $5.1 million in revenue, so to get $5 million in EBITDA we’d need a 98% net margin (meaning our costs would need to be non existent) Since this is a physical business vs software business (whereby software has very high margins) we cannot get that level of profit without increasing revenue.

If we keep the 23% net margin the same, we’d need 4x the current revenue (or about $21.25 million) to get there. We could also try to tackle the net margin itself, which would involve reducing costs. Given the existing Investment and Operating Expenses are needed to run the business, even if we reduce some costs, it’s unlikely we can get 4x improvement.

So the only way forward is to increase Throughput (Sales) by 4x. Another way to do that is to increase prices. A 4x price increase is very likely to impact sales negatively but we can still experiment with some increases and get some improvement that way.

If we choose to keep prices the same, we’d need 4x more customers. Can our current capacity handle 4x more customers? We don’t know but let’s assume that we can. Let’s say we can hire another doctor and double the capacity.

The Power of Focus

At this point I hope you can see that by focusing on just improving sales first, more specifically the number of new customers, we can not only achieve our goal of $5 million in EBITDA but also exceed it. The beauty of TOC is that it lets you focus on a single constraint until you break it and only then start thinking about what’s next.

There are surprisingly few levers needed to increase sales. Hormozi focuses on quite a few of them in the video:

Ensure there’s a need for your services (which Chiro-1st already handles well)

Improve the offer to the market. This can be done for example by changing the ad copy and tracking improvements in the conversion rate of

Improve the sales process by reconfiguring how the offer is presented. Hormozi spends most of his time giving recommendations here.

Increase prices. This is something else Hormozi mentions given that the sales conversion rate is “too high” and could indicate more room for prices to grow.

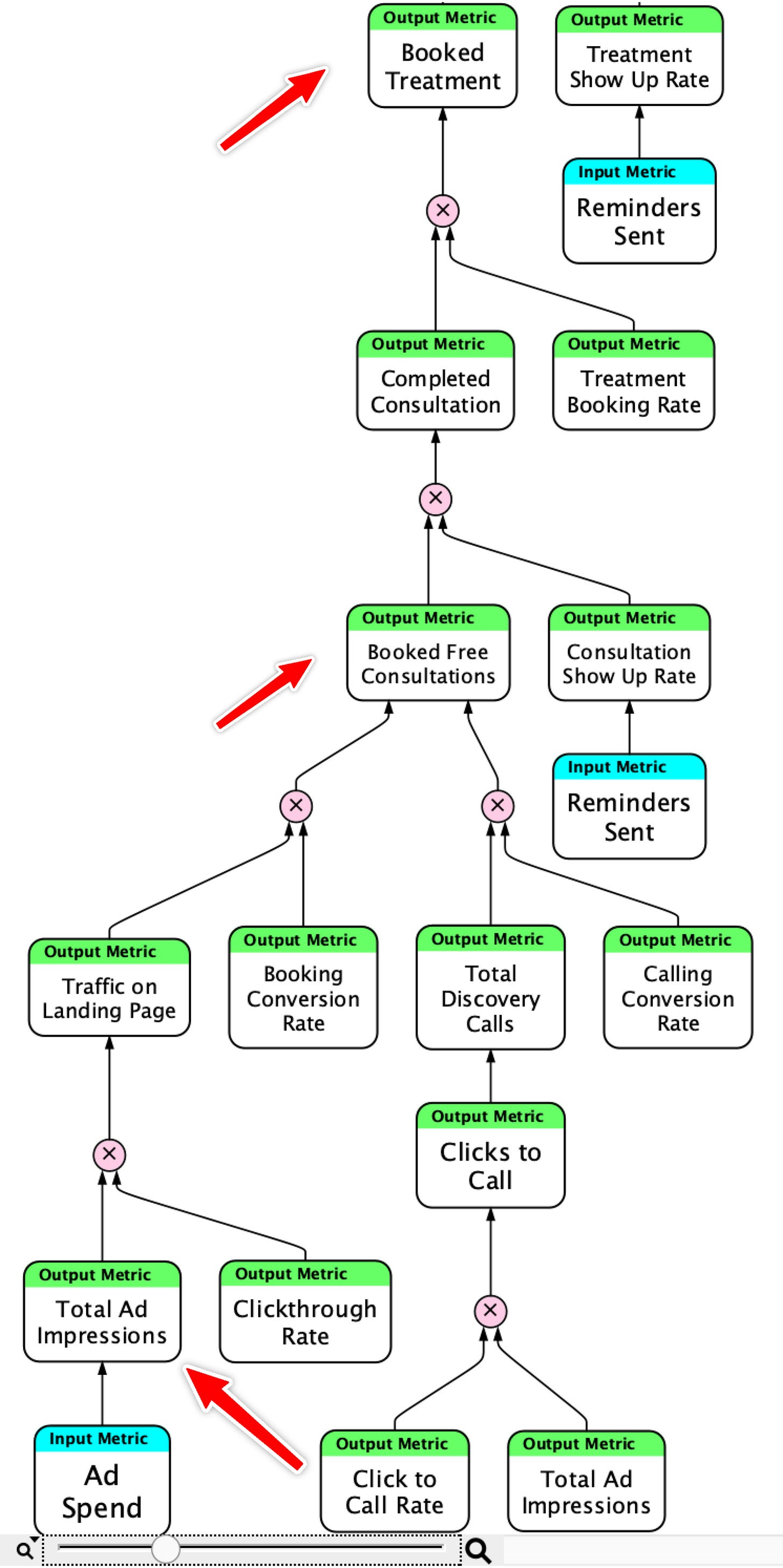

If we look at the bottom of the metrics tree from the previous post, we see that by improving the ad messaging and increasing the spend, we can directly increase the Booked Consultations. And by reconfiguring the offer, and standardizing how the consultation is offered we can also impact the close rate which will improve the Booked Treatment metric.

Hormozi gives far more specific advice but for educational purposes, this is plenty.

Other Considerations

How can we apply this approach to a business without physical locations (e.g a SaaS product)? Well when you build the first version of the product, your primary focus should be demand, or as is known in the industry as Product Market Fit (PMF)

Imagine this SaaS company who has 10 paying customers, whose product can handle a max of 100 users simultaneously, but the focus of all their engineering resources is on scaling the product.

As long as your product can handle the initial demand, don’t even think about spending engineering resources on scaling. Focus all your efforts on building features that close deals and get you closer to PMF.

Only when you’re swimming in support requests from users who can’t acccess or use your product should you concern yourself with scaling.

Here’s the link to the previous post and a summary of the metrics below if you choose not to read it.

Metrics / KPI’s Overview

Next let’s go over the metrics / KPIs and see if we can’t get a better idea about this business.

Top line

Top line revenue per location: $5.2 million

Net profit per location: $1.2 million which means

Net margin: 1.2/5.2 = 23%

Acquisition

Monthly marketing spend: $1,500-$2,000 per month

Total new leads avg: 35 per month

Total shows for free consultation: 28 (80% show rate on avg)

Total sales for full treatment: 20 (71% close rate on avg)

Customer acquisition cost (CAC): $700 per year

Retention

Lifetime Value (LTV) per customer: $3,400

LTV/CAC ratio: 3400/700 = 4.8

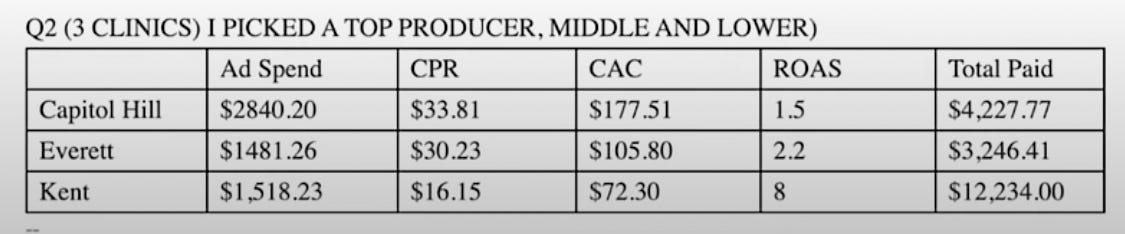

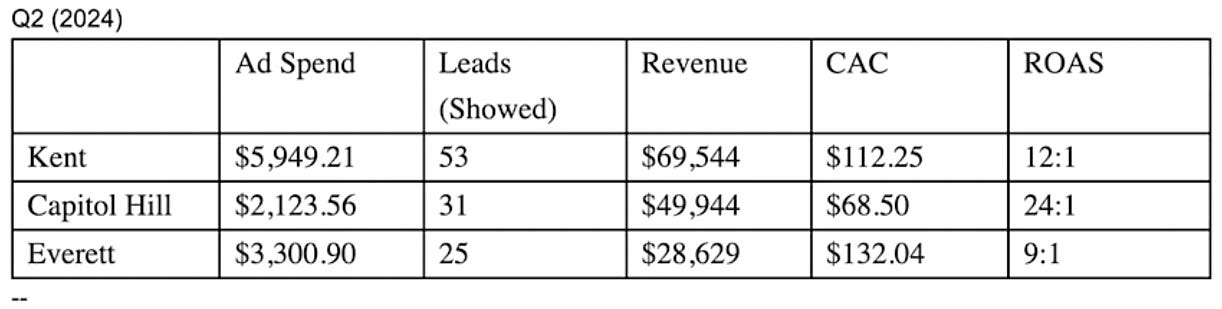

ROAS depends on location (this comes into play later)

Facebook Ads

Google Ads

That’s it' for this issue. Until next time.

Management attention - such an important part of TOC! I call it “mental budget”…as important as “financial budget”. :)